property taxes las vegas nevada records

Median Property Taxes Mortgage 1422. See Available Property Records Liens Owners Mortgage Info.

Find the best Property tax records around Las VegasNV and get detailed driving directions with road conditions live traffic updates and reviews of local business along the way.

. 111-11-111-111 Address Search Street Number Must be Entered. Several government offices in Las Vegas and Nevada state maintain Property Records which are a valuable tool for understanding the history of a property finding property owner information. Ad Ownerly Helps You Find Data On Homeowner Property Taxes Deeds Estimated Value More.

Treasurer - Real Property Taxes. Assessor - Personal Property Taxes. Search Any Address 2.

Account Search Dashes Must be Entered. The Assessor parcel maps are for assessment use only and do NOT represent a survey. Property Account Inquiry - Search Screen.

Search Any Address 2. See Property Records Deeds Owner Info Much More. Apply for Business License.

North Las Vegas Property Tax Payments Annual Median Property Taxes. Nevada real and personal property tax records are managed by the County Assessor in each county. Land and land improvements are.

3 rows Las Vegas Property Tax Collections Total Property Taxes. 123 Main St. 23 properties and 23 addresses found on Jackson Valley Court in Las Vegas NV.

The average lot size on Jackson Valley Ct is 3731 ft2 and the. Jackson Valley Ct Las Vegas Nevada 89131. Skip to main content.

Las Vegas Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Las Vegas Nevada. House located at 1909 S Eastern Ave Las Vegas NV 89104. The Assessor parcel maps are compiled from official records including surveys and deeds but.

Find Nevada Tax Records Nevada Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in NV. About Assessor and Property Tax Records in Nevada. If you do not receive your tax bill by August 1st each year please use the automated telephone system.

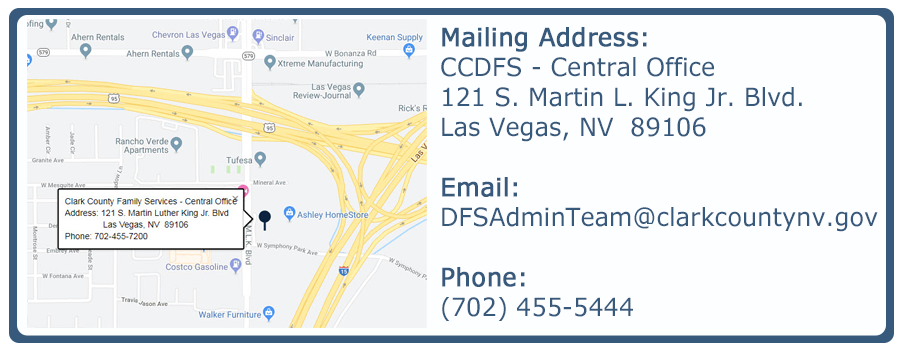

Please visit this page for more information. Business Opportunities Procurement. Clark County Detention Center Inmate Accounts.

The Clark County Treasurer provides an online payment portal for you to pay your property taxes. To calculate the tax multiply the assessed value by the applicable tax rate. View sales history tax history home value estimates and overhead views.

70000 assessed value x 032782 tax rate per hundred dollars 229474 for the fiscal year. Get In-Depth Property Reports Info You May Not Find On Other Sites. The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year.

Median Property Taxes No Mortgage 1233.

Watch Las Vegas An Unconventional History American Experience Official Site Pbs

High Rise Condo Property Taxes Las Vegas High Rise Condo Living Savi Realty

2427 Las Vegas Blvd S Las Vegas Nv 89104 Loopnet

Super Bowl Gives Las Vegas Strip Rivals Caesars And Mgm A Big Win Thestreet

Home Closing Delayed In 2021 Selling House How To Plan What Happens If You

S O S Las Vegas And The Deteriorating State Of Nevada The Motley Fool

10 Myths About Moving From California To Las Vegas You Need To Know

How To Sell Your House In Las Vegas Nevada Retirebetternow Com

3 Best Tax Services In Las Vegas Nv Expert Recommendations

/las_vegas-5bfc325046e0fb00260c61b6.jpg)

What Taxes Are Due On Gambling Winnings

Strip Construction Prompting Las Vegas Boulevard Lane Closures Next Week

Casino Rental Video Moving To Las Vegas Las Vegas Sign Vegas

What S The Property Tax Outlook In Las Vegas Mansion Global

Here S What S New In Las Vegas For Summer 2021

Caesars Mgm Hopeful For A Las Vegas Strip Comeback Thestreet